A commodity index designed to be a broadly diversified commodity exposure and inflation hedge

The Quantix Commodity Index

Index Overview

The Quantix Commodity Index (“QCI” or “Index”) is a dynamic commodity index with the objective of being a broadly diversified commodity exposure and inflation hedge for investors. Unlike traditional commodity indices, which use volume or production data to determine weights, the QCI has been designed with the goal of increasing the correlation to inflation and reducing the cost of carry over time.

Commodity futures are unique in their relationship to inflation and are generally regarded as having the highest positive correlation to inflation of all the major asset classes.

The Index aims to achieve its objective by compiling a diversified grouping of commodity futures contracts that track commodities across all the major sectors. The weights reflect the relative inflation sensitivity of each commodity referenced by the futures contracts, the type of inflation, and the cost of holding and rolling a position in the particular futures contract.

Solactive AG is the calculation agent for the Index which is distributed under the tickers:

QCITR: The Quantix Commodity Index Total Return

QCIER: The Quantix Commodity Index Excess Return

The Index is rebalanced once a quarter and was first published in January 2022.

From January 2022 to February 2023, the Index was known as the Quantix Inflation Index.

Performance of QCI (including pre-inception backtest) vs Actual Performance of a Traditional Commodity Benchmark

Source data: Quantix Commodities Indices LLC, Quantix Commodities, Bloomberg

Date range: 31-Dec-00 to 31-Dec-23. The index Launch Date is 14-Jan-21. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date.

The chart above shows the performance of the Index from 31-Dec-00 through 31-Dec-23 in comparison with a traditional commodities index, the S&P GSCI Commodity Index (GSCI®) Total Return. This index is shown for illustrative purposes only on the basis of being a broad representation of the commodity futures market, with certain limitations, and with no ability to invest directly in this index. The data for the QCI Total Return Index is derived by using the Index's calculation methodology with historical prices for the futures contracts comprising the Index.

Index History

Developed by Quantix Commodities LP and owned by Quantix Commodities Indices LLC, the index draws upon the commodity experience and index structuring expertise of the Quantix team. The Index was first published in January 2022. From January 2022 to February 2023, the Index was known as the Quantix Inflation Index.

Index Performance

The Index Launch Date was 14-Jan-22. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date.

* Including QCI TR pre-inception, hypothetical backtest prior to 14-Jan-22

Source data: Quantix Commodities Indices LLC, Quantix Commodities, Bloomberg

The table above shows the performance of the Index from 31-Dec-00 through 31-Dec-23 in comparison with a traditional commodities index, the S&P GSCI Commodity Index (GSCI®) Total Return. This index is shown for illustrative purposes only on the basis of being a broad representation of the commodity futures market, with certain limitations, and with no ability to invest directly in this index. The data for the QCI Total Return Index is derived by using the Index's calculation methodology with historical prices for the futures contracts comprising the Index.

In the table above, "Return" refers to the return of the relevant index from 31-Dec-00 through 31-Dec-23; "Volatility" refers to the monthly standard deviation multiplied by the square root of 12.

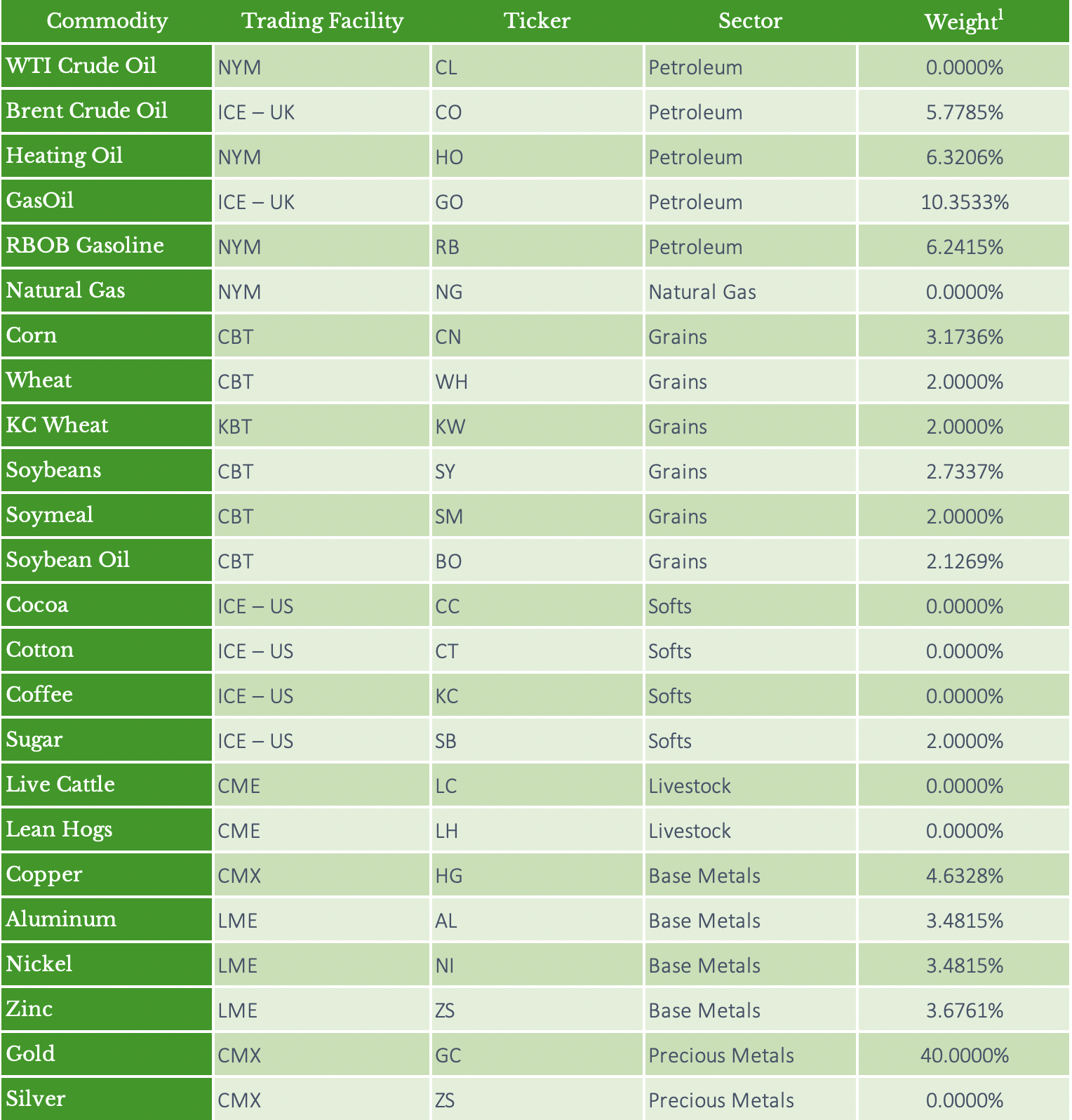

QCI Eligible Commodities

1 As of most recent rebalance in December 2023.

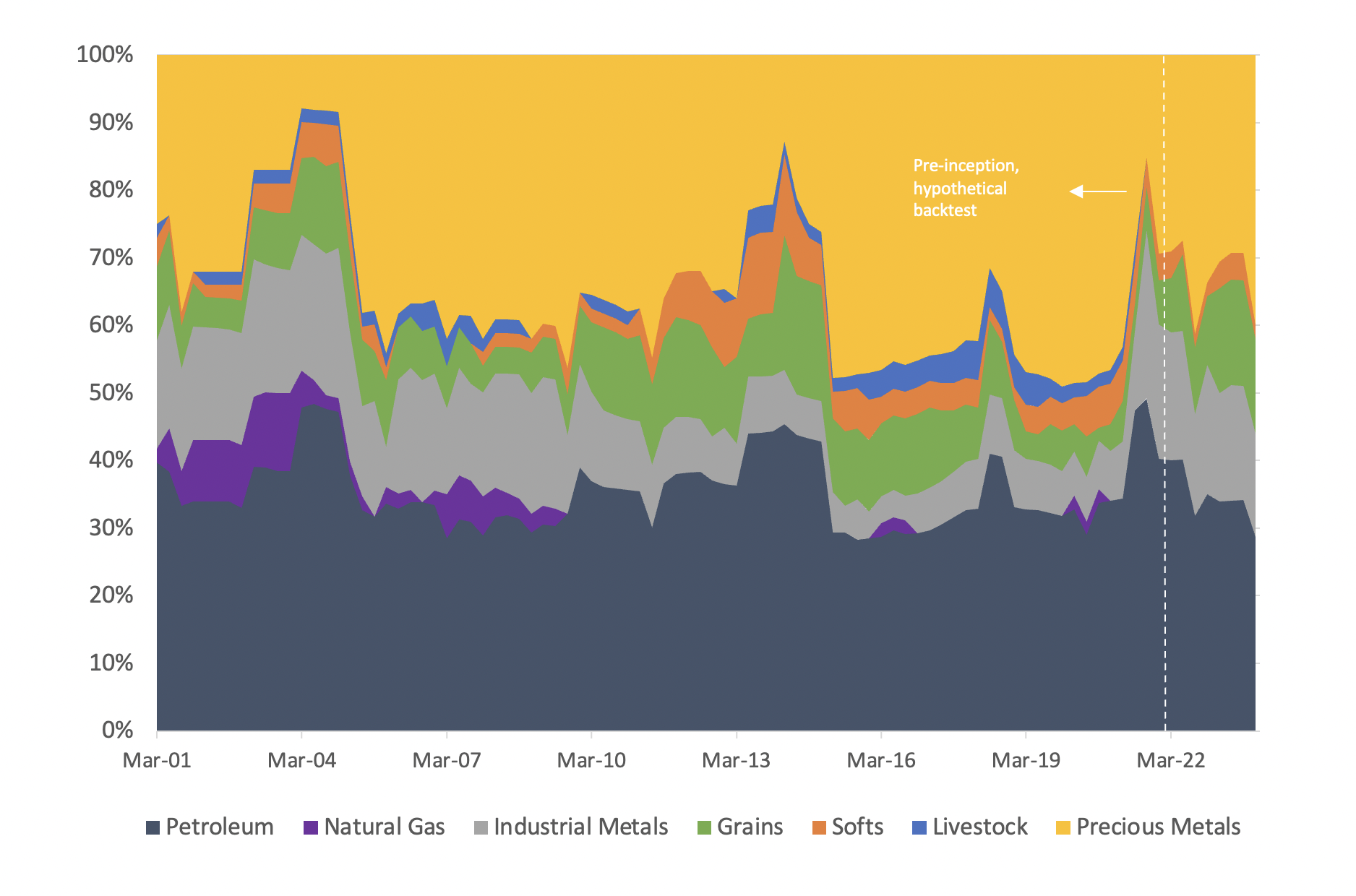

Historical Weights

Source data: Quantix Commodities Indices LLC, Quantix Commodities, Bloomberg. The Index Launch Date is 14-Jan-21. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date.

The chart above shows the weights of the QCI Total Return Index, derived by using the Index's calculation methodology with historical prices for the futures contracts comprising the Index, from 31-Dec-00 through 31-Dec-23.

Index Methodology

Index Announcements

-

-

QUANTIX COMMODITIES INDICES LLC ANNOUNCES THE 4Q23 TARGET WEIGHTS FOR THE QUANTIX COMMODITY INDEX

QUANTIX COMMODITIES INDICES LLC ANNOUNCES THE 3Q23 TARGET WEIGHTS FOR THE QUANTIX COMMODITY INDEX

QUANTIX COMMODITIES INDICES LLC ANNOUNCES THE 2Q23 TARGET WEIGHTS FOR THE QUANTIX COMMODITY INDEX

QUANTIX COMMODITIES INDICES LLC ANNOUNCES THE 1Q23 TARGET WEIGHTS FOR THE QUANTIX INFLATION INDEX

-

Disclaimers

The Quantix Commodity Index (“QCI”) was launched on January 14, 2022. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed over that time period had the index existed) based on the index methodology in effect on the launch date. Back-tested performance is hypothetical and based on a methodology and components selected with the benefit of hindsight and knowledge of factors which may have positively impacted the back-tested results and may reflect survivor/look ahead bias. In addition, the QCI may have used certain inputs into calculation which were not available at the time. Furthermore, back-tested QCI returns do not reflect limitations on trading (“market disruption events”) which will be reflected in the calculation of the index subsequent to launch. The QCI was known as the Quantix Inflation Index from January 2022 to February 2023.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Index returns do not reflect the results of actual trading and thus may not reflect returns which could have been achieved by trading actual assets. They also do not reflect any transaction costs or fees which could be charged.

Back-tested performance is for use with institutions only; not for use with retail investors.

All rights to the trade mark, name and intellectual property associated with the Index is the property of Quantix Commodities Indices LLC. No representation is made by Quantix Commodities Indices LLC that the Index is accurate or complete or that any investment in the Index or in a product that tracks the Index will be profitable or will achieve the design objectives. This is not a recommendation by Quantix Commodities Indices LLC to invest in the Index or in any product that tracks the Index. The Index is calculated by Solactive and Quantix Commodities Indices LLC will have no liability for any error in calculation of the Index.

Neither the Index nor any financial instrument linked to the Index is sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade mark or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade mark for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

The Quantix Inflation Index is based in whole, or in part, on the ICE Cotton, ICE Coffee, ICE Cocoa, ICE Sugar, ICE Gas Oil, ICE Crude Oil Brent owned by ICE Data, LLP and its Affiliates, and is used by Quantix Commodities Indices LLC with permission under license by ICE Data, LLP.

The trademarks ICE, ICE DATA, ICE FUTURES, ICE FUTURES EUROPE, ICE FUTURES U.S., COFFEE “C”, COTTON NO2, SUGAR NO.11, COCOA, CRUDE OIL BRENT and GAS OIL are owned by ICE Data, LLP and its affiliates, and are used by Quantix Commodities LLC with permission under license by ICE Data, LLP.

NEITHER THE INDICATION THAT SECURITIES OR OTHER FINANCIAL PRODUCTS OFFERED HEREIN ARE BASED ON DATA PROVIDED BY ICE DATA LLP, NOR THE USE OF THE TRADEMARKS OF ICE DATA LLP IN CONNECTION WITH SECURITIES OR OTHER FINANCIAL PRODUCTS DERIVED FROM SUCH DATA IN ANY WAY SUGGESTS OR IMPLIES A REPRESENTATION OR OPINION BY ICE DATA OR ANY OF ITS AFFILIATES AS TO THE ATTRACTIVENESS OF INVESTMENT IN ANY SECURITIES OR OTHER FINANCIAL PRODUCTS BASED UPON OR DERIVED FROM SUCH DATA. ICE DATA IS NOT THE ISSUER OF ANY SUCH SECURITIES OR OTHER FINANCIAL PRODUCTS AND MAKES NO EXPRESS OR IMPLIED WARRANTIES WHATSOEVER, INCLUDING BUT NOT LIMITED TO, WARRANTIES OF MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE WITH RESPECT TO SUCH DATA INCLUDED OR REFLECTED THEREIN, NOR AS TO RESULTS TO BE OBTAINED BY ANY PERSON OR ANY ENTITY FROM THE USE OF THE DATA INCLUDED OR REFLECTED THEREIN.

The LME shall have no liability for any loss or damage incurred as a result of any errors, inaccuracies or omissions in relation to the LBMA Platinum Price and/or LBMA Palladium Price, or for any delay in publishing the LBMA Platinum Price and/or LBMA Palladium Price, or for any other reason whatsoever in connection with the LBMA Platinum Price and/or LBMA Palladium Price. The LME is unable to provide any warranty relating to the accuracy of the LBMA Platinum Price and/or LBMA Palladium Price and no reliance should be placed on the LBMA Platinum Price and/or LBMA Palladium Price by any person. Unless otherwise stated, the copyright and any other rights in the contents relating to the LBMA Platinum Price and LBMA Palladium Price, including any images and text, shall remain the property of the LBMA.

CME GROUP MARKET DATA IS USED UNDER LICENSE AS A SOURCE OF INFORMATION FOR CERTAIN Quantix Commodities Indices LLC PRODUCTS. CME GROUP HAS NO OTHER CONNECTION TO Quantix Commodities Indices LLC PRODUCTS AND SERVICES AND DOES NOT SPONSOR, ENDORSE, RECOMMEND OR PROMOTE ANY Quantix Commodities Indices LLC PRODUCTS OR SERVICES. CME GROUP HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE Quantix Commodities Indices LLC PRODUCTS AND SERVICES. CME GROUP DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF ANY MARKET DATA LICENSED TO Quantix Commodities Indices LLC AND SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN CME GROUP AND Quantix Commodities Indices LLC.